Loans can be divided into two types: secured and unsecured loans.

A secured loan is a loan backed by assets. With a secured loan, you essentially promise to pay back the money borrowed, and if you fail to do so, the lender can take ownership of the loan asset. Examples of secured loans include mortgages (where a house is the asset) and auto loans (where a car is the asset).

An unsecured loan does not require an asset and the lender only charges interest and fees. Common examples of unsecured loans include personal loans and credit cards.

When evaluating an application for an unsecured loan, banks and financial institutions rely primarily on your income, credit score and history of repaying previous debts. As a result, unsecured loans may have higher interest rates than secured loans.

| Asset Required | Amount | Term | Interest Rate | Example | |

|---|---|---|---|---|---|

| Unsecured Loan | No | Usually based on the applicant’s creditworthiness | Shorter repayment terms | Usually higher than secured loans | Personal Loan |

| Secured Loan | Yes | Usually based on value of asset | Longer repayment terms | Usually lower than unsecured loans | Car Loan, Home Loan |

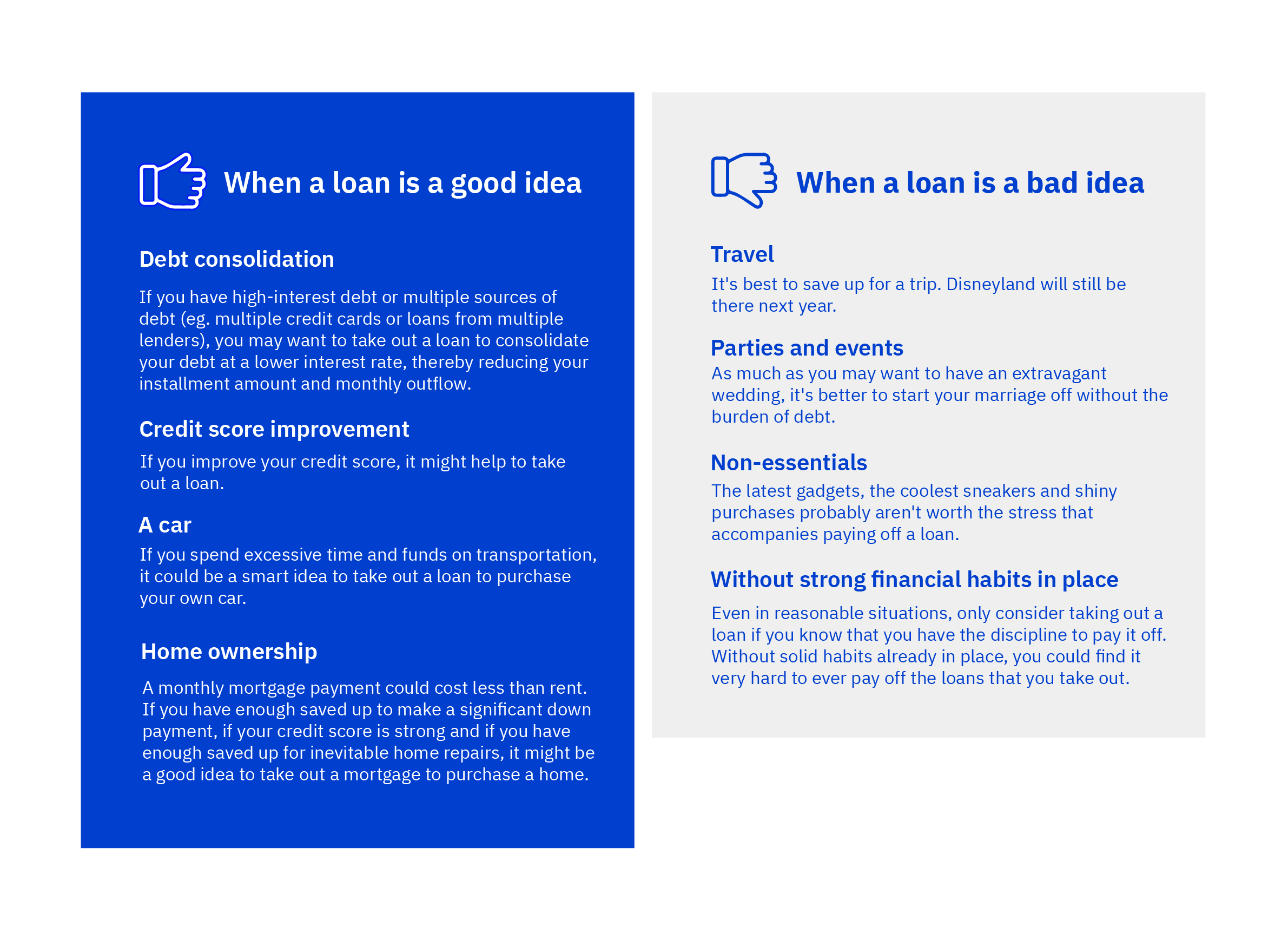

Before agreeing to any loan, think about why you’re borrowing the money and if you can comfortably afford the payments. For example, an education loan might be viewed as a long-term investment because obtaining a degree will eventually lead to a higher salary, making it easier to pay back the loan. Similarly, taking out a loan to buy a house means you can own an asset that may appreciate in value over time.

The views shared in this podcast are for general information and educational purposes only and do not constitute financial, investment, legal or tax advice. Listeners should seek independent advice from a qualified professional before making any financial decisions. Emirates NBD Bank PJSC accepts no liability for any loss arising from reliance on the content discussed.