Diversification is the process of spreading out your money amongst several different assets. This way, you don’t rely on one single investment for your portfolio.

When you invest your money, you’ll always have some sort of investment risk. While you can never completely get rid of these risks, you can try to minimize them.

By diversifying and putting your money into a number of different types of investments, you can lessen the risk that any one investment can cause a substantial loss to your portfolio. Diversification is the best way to make sure you don’t risk a lot of your money on one investment.

By diversifying your investments across stocks, bonds, and other assets, your investments will hopefully balance each other out in times when certain investments aren’t doing well. For example, when the stock market is falling, bond prices are rising. This means, if you hold not just stocks, but also bonds, then you aren’t at risk to as much volatility as if you only owned stocks.

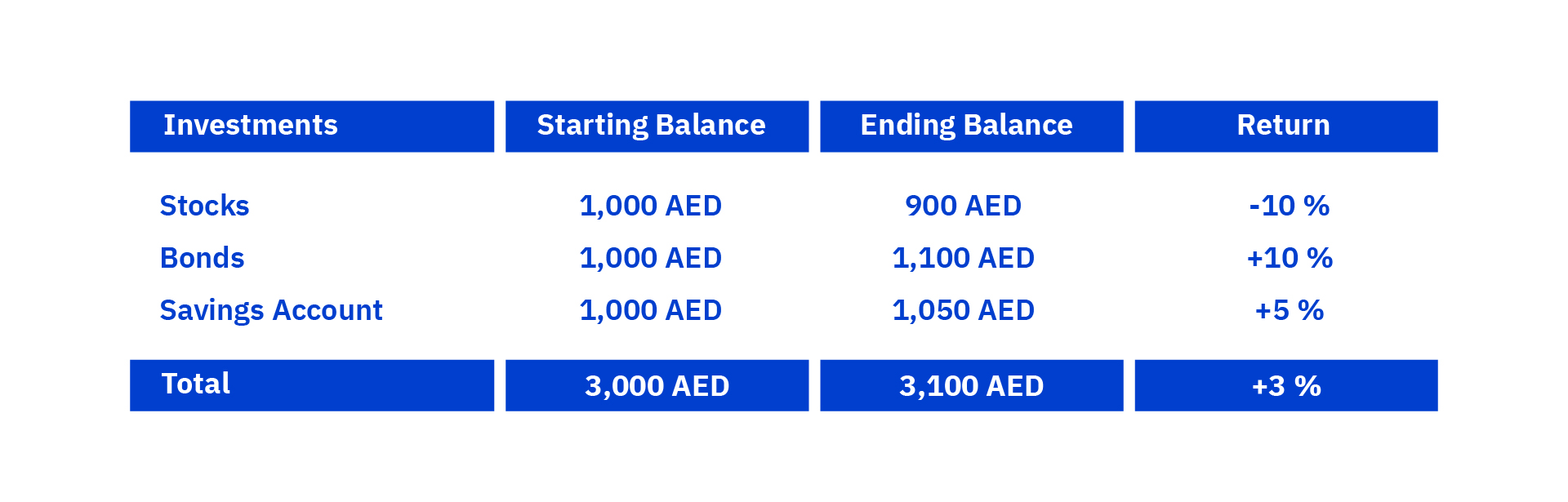

Let’s say you have your money invested in stocks, bonds, and a savings account. Unfortunately, the stock market doesn’t do so well, and you lose money on those investments. If you had invested in stocks only, you would have lost money overall. But since you invested in bonds and a savings account, your total portfolio actually made money overall.

There are a wide variety of investment options out there to choose from. Hopefully you can see now that it’s important to not just pick one investment type and stick with it, but instead diversify your money across different types of investments. Here are some different types of investments you can choose from to diversify your portfolio.

Diversification can reduce your risk of losing a large amount of your portfolio at one time, by spreading out your risk so that you’re less likely to suffer a major loss.

Make sure you do proper research before making any investments and consult with professional financial advisors.

The views shared in this podcast are for general information and educational purposes only and do not constitute financial, investment, legal or tax advice. Listeners should seek independent advice from a qualified professional before making any financial decisions. Emirates NBD Bank PJSC accepts no liability for any loss arising from reliance on the content discussed.