A fixed deposit is a banking product that allows you to be paid interest on your deposit for a fixed amount of time. This is also referred to as a term or time deposit. You put money into a fixed deposit for a set amount of time, anywhere from 7 days to 5 years or more. The original amount you put into a fixed deposit — also known as the “principal amount” — is guaranteed. And you earn interest on it.

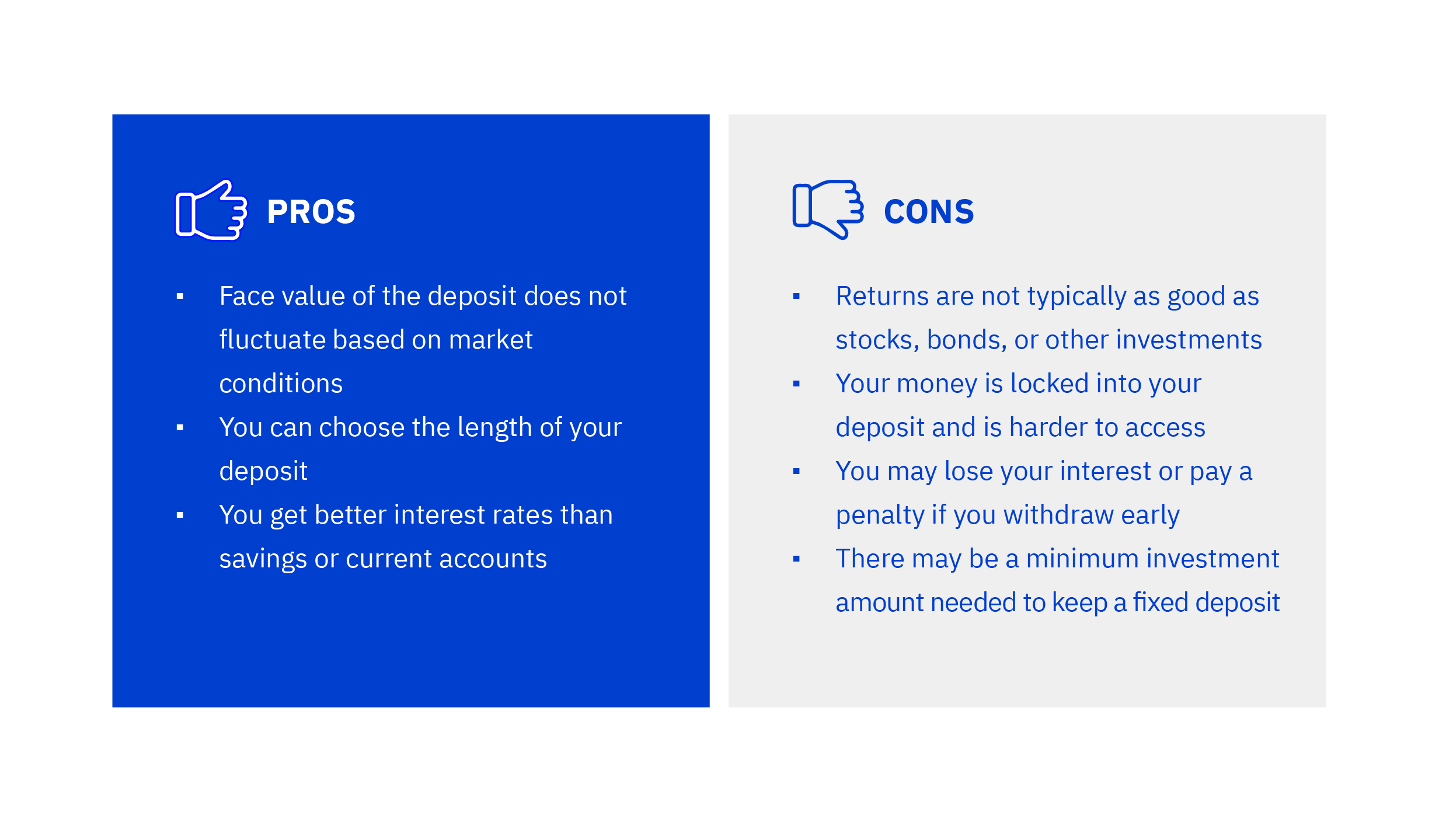

A fixed deposit is a much safer way of getting a return on your money, compared to other investment products like stocks or bonds. You’re guaranteed a fixed interest (or “return”) as long as you keep the money in the bank for the contractual period.

Unlike other investments, a fixed deposit ties your money up for a specified length of time. In general, the longer you deposit your money, the better the interest rate that will be offered to you. But that also means you may not withdraw your money before the end date of the term deposit. If you need cash suddenly, you might suffer a penalty and lose interest for withdrawing your money prematurely.

Your principal amount in a fixed deposit is guaranteed by your bank and you’ll receive interest for your deposit. If you really want to get the most out of your fixed deposits, you could also consider reinvesting the interest that you earned back into a fixed deposit, to get compound interest on your money. Compounding your interest over time will create even more savings than before.

Sure, you won’t be making a large amount of money with a fixed deposit like you potentially could in the stock market, but you also won’t be taking the risk of losing your money either. This makes fixed deposits a good, safe choice for your portfolio.

The views shared in this podcast are for general information and educational purposes only and do not constitute financial, investment, legal or tax advice. Listeners should seek independent advice from a qualified professional before making any financial decisions. Emirates NBD Bank PJSC accepts no liability for any loss arising from reliance on the content discussed.