An emergency fund is exactly what it sounds like: money you set aside for emergencies. With an emergency fund, you’ll be able to pay for expenses that come up at any moment. It doesn’t matter what else is going on in your life, your emergency fund is meant to take care of you when you need it.

All it takes is setting money aside each week or month for your fund. Try opening a new bank account just for your emergency fund, that way you can always see your balance.

Make sure that you can easy access to your emergency fund, just in case anything comes up. Since you (hopefully) won’t be withdrawing money all that often, a savings account can be a good place to park your emergency funds, so that you’re earning some interest on your money as well.

The money you set aside for your emergency fund should only be used in case of an emergency. How you define an emergency might be different from someone else, but it’s safe to say that splurging on a new pair of shoes doesn’t count. Sit down and write a list of all the reasons you might use your emergency fund. That way, it’s clear why this money might be used, and you won’t be tempted to spend the savings on other things.

There is no one set amount that is good for an emergency fund, but there are some rules that could help you to figure out how much to put away. Most financial experts agree that you should save between three and six months’ worth of your expenses. This is to protect you in case you lose your job and need a few months to get back on your feet.

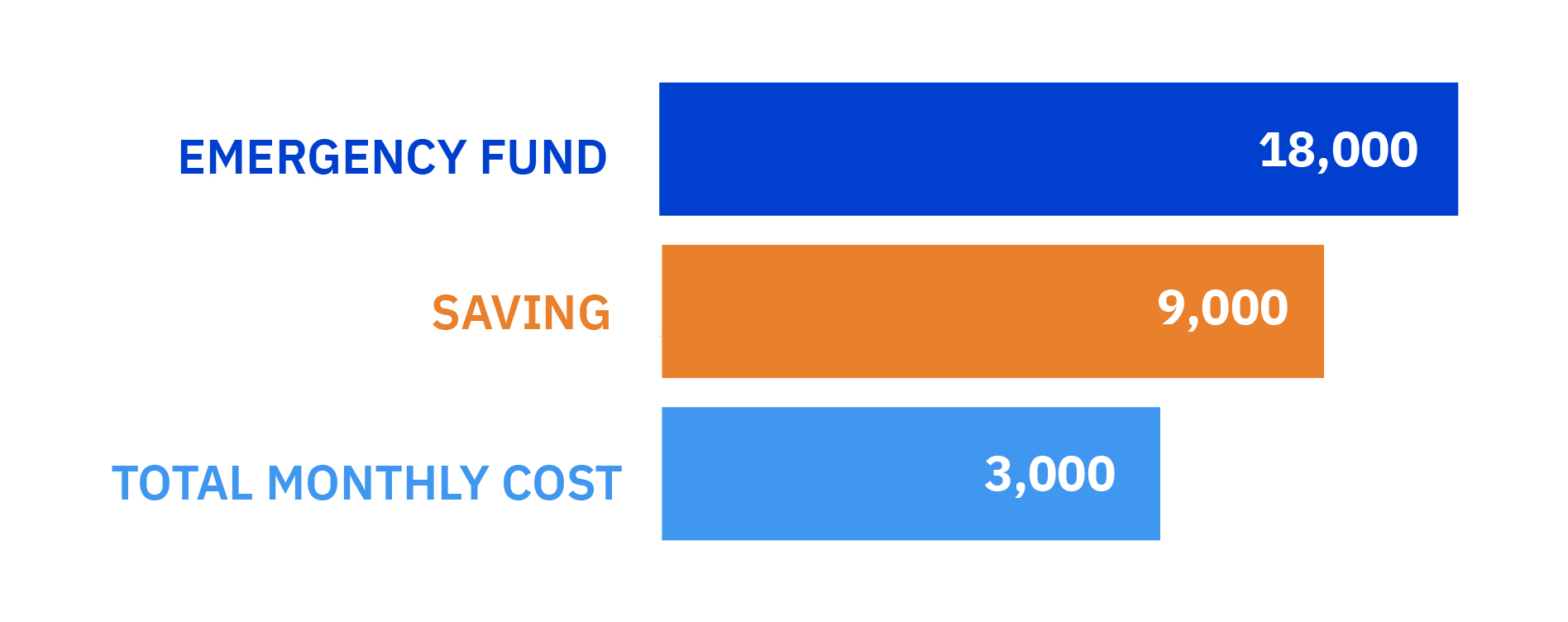

For instance, if your total monthly costs are AED 3,000, you should be saving between AED 9,000 and AED 18,000 in your emergency fund. In the worst-case scenario, this should be enough money to pay for your living expenses and keep you protected until you get back on your feet.

An emergency fund might not be the most exciting financial decision you can make, but it could be one of the most important. Knowing you have money for emergencies will provide you with that extra peace of mind in your financial life, and allow you to sleep better at night.

The views shared in this podcast are for general information and educational purposes only and do not constitute financial, investment, legal or tax advice. Listeners should seek independent advice from a qualified professional before making any financial decisions. Emirates NBD Bank PJSC accepts no liability for any loss arising from reliance on the content discussed.