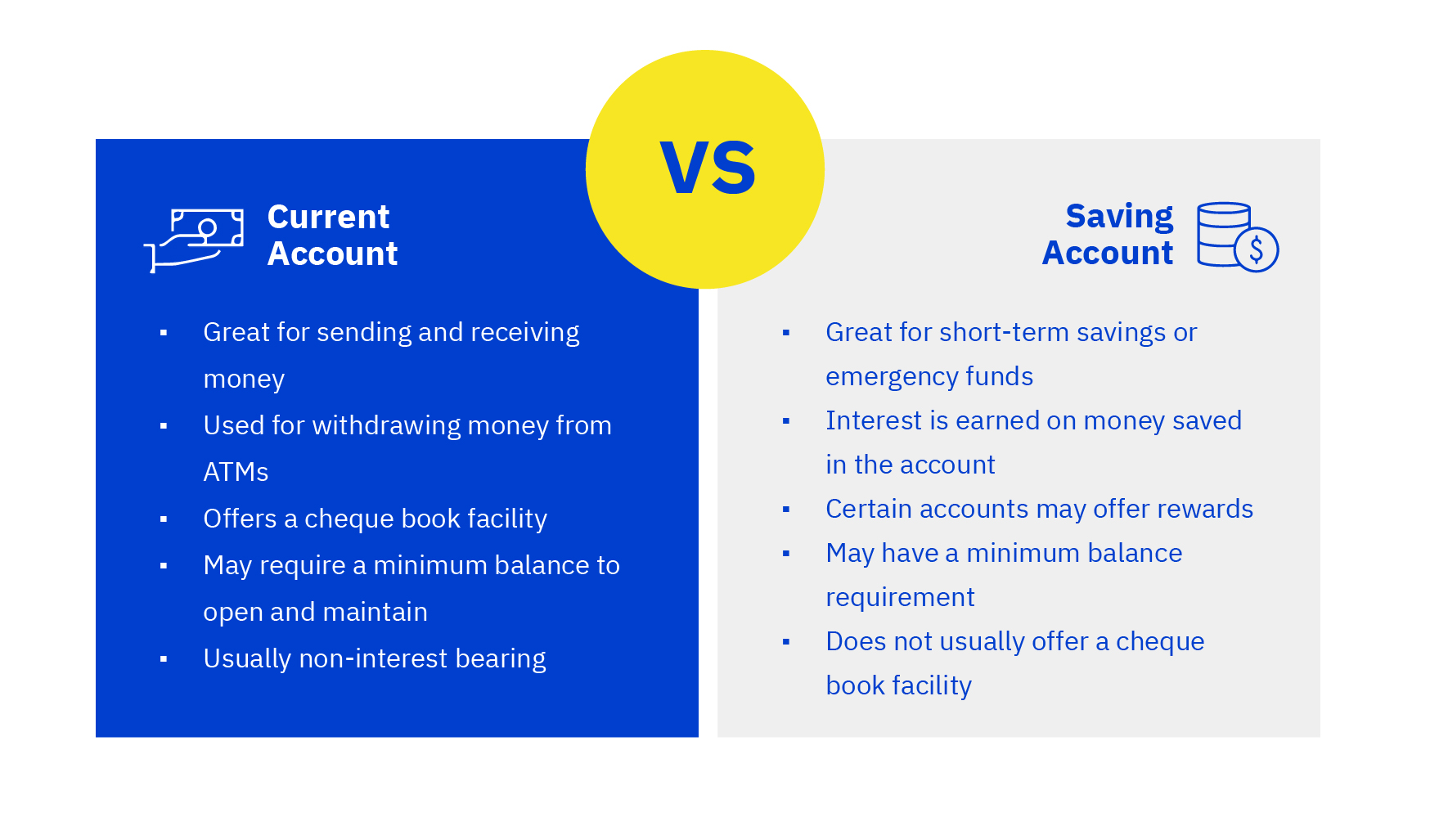

Understanding how and when you can use different bank account types is an important part of personal finance. To start with, here’s the difference between a Current Account and a Savings Account. Let’s examine the features that make each of these accounts unique.

A current account is a bank account that is designed for everyday use, including depositing, and withdrawing money as needed. Many people use current accounts for their salary, paying bills, withdrawing cash from ATMs, and writing cheques.

Some banks have a “minimum balance requirement” that you need to maintain in order to keep your current account open. This means that to open a current account, you’ll have to deposit at least the minimum amount into it. And once the account is open, the minimum balance must be maintained or you‘ll be charged a fee every month that the balance goes below that minimum.

Current accounts have the greatest flexibility for transactional benefits. These types of accounts aren’t the best for saving money though, since they don’t earn much (if any) interest. However, for going shopping, paying a mortgage, or writing cheques, a current account is a great choice.

A savings account is a type of bank account for saving money and earning interest on that saved money. Most savings accounts pay some interest, but not a lot, since the money in these accounts can be withdrawn at any time.

While you can still spend or withdraw money from savings accounts, they aren’t the best for daily use. For example, some savings accounts might limit the number of withdrawals you can make per month; some savings accounts don’t come with cheques. So make sure you check out the features of your account.

Some banks have a minimum balance requirement to open or maintain savings accounts.

Savings accounts can be an excellent choice for short-term savings and emergency funds. A savings account is used mainly for deposits, while the money in the account is easily accessible if the need arises, offering flexibility. You can choose this account to save up for a specific goal in mind, such as a fun trip abroad, buying a car or a deposit for a house..

The views shared in this podcast are for general information and educational purposes only and do not constitute financial, investment, legal or tax advice. Listeners should seek independent advice from a qualified professional before making any financial decisions. Emirates NBD Bank PJSC accepts no liability for any loss arising from reliance on the content discussed.