The bank (or card issuer) determines the credit limit (how much money can be spent on the card) based on your income, credit score, and credit history.

Every card has a unique 16-digit number. This number, along with other information on the card (like expiration date and security code), can be used for your purchases. When you use your credit card to buy something, a notification is sent to the bank which instantly pays the seller on your behalf.

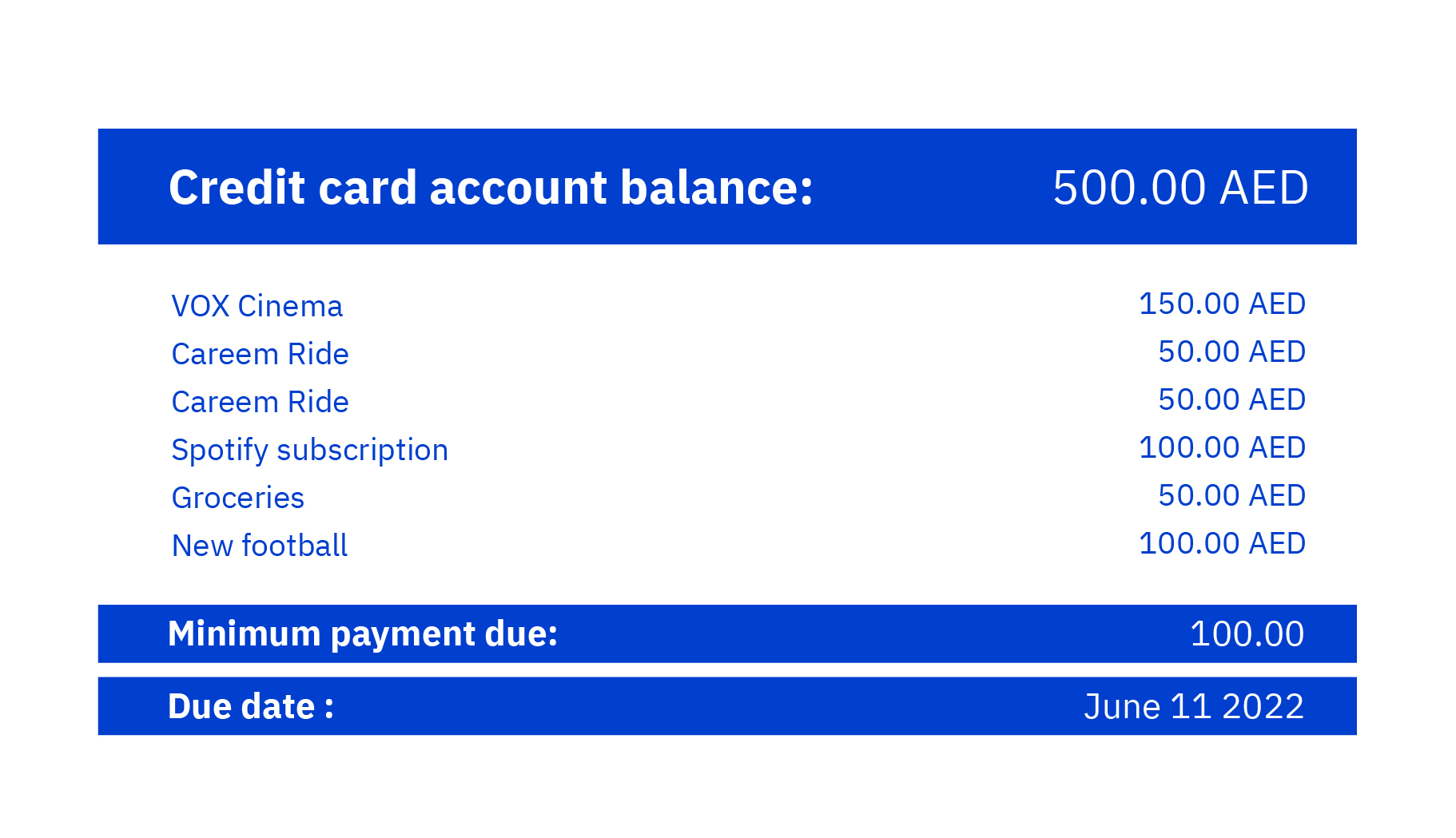

You receive a credit card statement every month (some banks let you choose a different duration too), listing all your transactions for that period and the amount you owe the bank, along with the minimum payment. If it’s a cashback card, your statement will also list the amount of cash you’ve earned back from all your transactions.

Here’s what a statement typically looks like:

*This statement is for illustrative purposes only and the format varies from bank to bank.

You can opt to pay the minimum amount on your statement but remember that the remaining balance will attract a high interest rate and if you pay only the minimum amount every month, your debt will soon spiral out of control. So, the best strategy is to pay the off before the due date every month and keep your debt well in control.

Fortunately, we don’t have to pay off our credit card bill every time we make a purchase. And that’s one of the big wins with credit cards – some of them offer an interest-free grace period on new purchases (usually between 21 and 25 days). So, if you choose, you can go ahead and spend now, but just make sure you pay up before your next statement due date.

Credit cards can vary not just on their terms and interest rate, but their rewards as well. Banks often partner with organizations to provide discounts, tickets, event access and more, as exclusive perks for their cardholders. For example, credit cards linked to airlines might reward you with loyalty points that can be redeemed for seat upgrades or flights.

When choosing a credit card, here’s what you should look out for:

Annual Percentage Rate (APR)This is the interest rate on the card. Compare the APRs of various cards to see which one charges the least interest.

Minimum paymentThis is the lowest payment that can be made each month on a credit card balance to remain in good standing with the borrower. But remember, if you only make the minimum payment, you will be charged interest on the remaining balance.

Annual feeWhile many credit cards are free, some have an annual fee. In some cases, these cards offer lower interest rates. Find out more about the card you’re interested in.

ChargesMake sure to check the schedule of charges and the terms and conditions to see whether there are any additional fees associated with the card. Some cards might charge for exceeding the credit limit, using a card abroad, or making late payments.

Loyalty points or rewardsCredit card points accumulate based on how much you spend on the card and can be redeemed in exchange for items at certain retailers, or as statement credits on the next bill. Look at how and where the incentives can be utilized, as well as what rewards seem most beneficial for you.

CashbackCashback credit cards allow you to get back some of the money spent on the card. Cashback cards usually offer a percentage reward which you can use to pay the credit card bill. Keep in mind that some cards may only allow cashback to be applied if the entire balance is paid every month. You may find a lower interest rate to be a better option than cashback if you can’t regularly pay your balance in full.

Understanding how a credit card works and the terms and conditions of different cards will help you determine which card is best for you.

Remember, if you have any questions or concerns about a card, always reach out to a customer care representative at the bank that issued the card.

The views shared in this podcast are for general information and educational purposes only and do not constitute financial, investment, legal or tax advice. Listeners should seek independent advice from a qualified professional before making any financial decisions. Emirates NBD Bank PJSC accepts no liability for any loss arising from reliance on the content discussed.