Your credit report pulls together information relating to your borrowing and credit history. This can be used by banks, financial institutions, utility companies, or the government. Your credit report does include your credit score, but it also includes much more information that lenders and other entities might use, to see how trustworthy you are at paying back your debts.

Your credit report will have a variety of different information relating to your credit history. The most basic information includes:

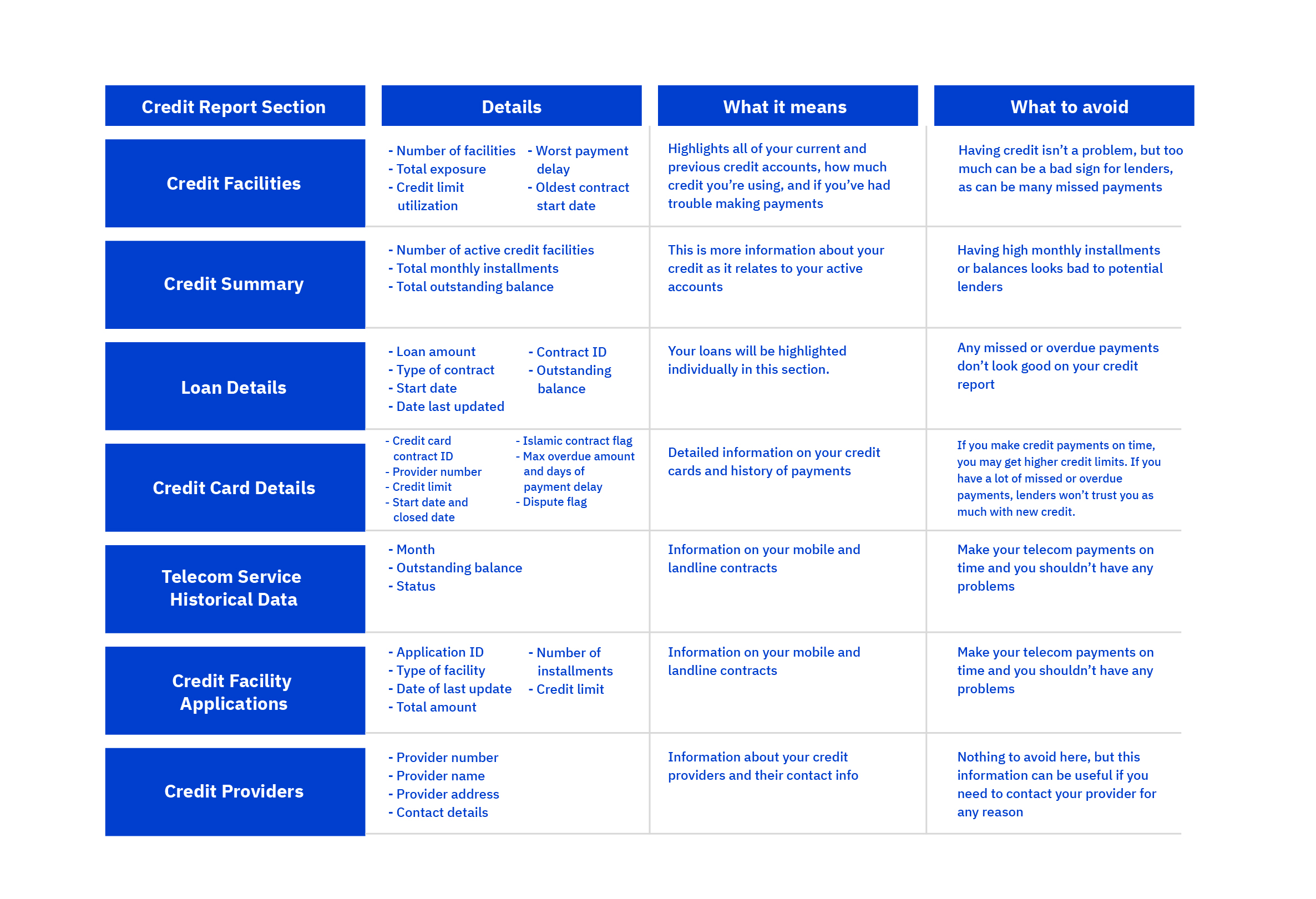

Below, you can see the different sections on your credit report as they relate to your credit history, the detailed information included in each section, what the information means, and what you should avoid.

Now that you know how to read your credit report, here in the UAE you can go ahead and get it from the Al Etihad Credit Bureau (AECB). You can get a credit report anytime you like, but remember there are fees involved in getting your report generated.

Download the AECB report app and have your credit report at your fingertips.

The biggest piece of information on your credit report is your credit score. This is a number ranging from 300 to 900. The higher your score, the more trustworthy you appear to lenders. You should do your best to have a credit score around 700 so that you can get better interest rates and faster approvals in the future, if needed.

The views shared in this podcast are for general information and educational purposes only and do not constitute financial, investment, legal or tax advice. Listeners should seek independent advice from a qualified professional before making any financial decisions. Emirates NBD Bank PJSC accepts no liability for any loss arising from reliance on the content discussed.