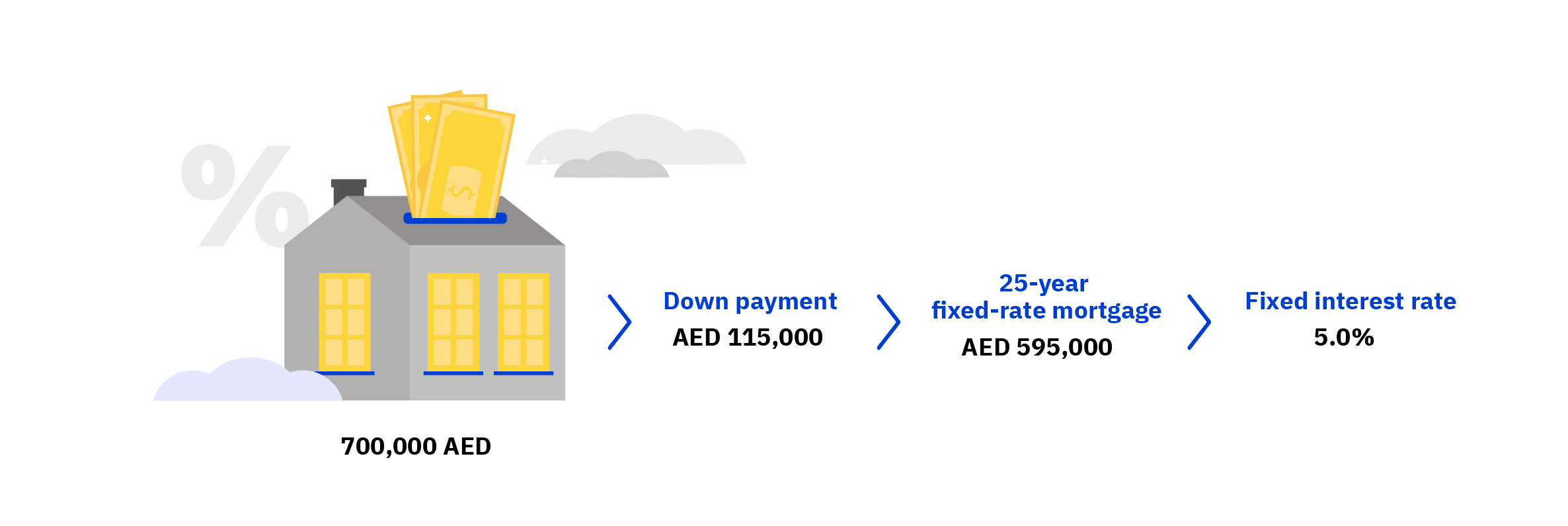

A fixed rate of interest remains the same for the entire duration of the loan. Let’s say you buy a house for AED 700,000 with a down payment of AED 115,000. The home is financed with a 25-year fixed-rate mortgage on AED 595,000 at a fixed interest rate of 5.0%.

In this scenario, the monthly housing payment (not including insurance and any applicable fees) will be roughly AED 3,478. This means that for all 25 years of the mortgage (unless the home is sold, refinanced, or paid off), you will pay the same 5% interest keeping your monthly mortgage payment constant at AED 3,478. Even if market interest rates go up, the rate is locked in for the duration of the loan.

A variable interest rate means that the interest rate can change during the life of the loan. If you apply for a mortgage with a variable interest rate, you might be offered an introductory interest rate of 4.0%. In some cases, this introductory rate can remain the same for the first 3 or 5 years regardless of whether or not the bank changes its interest rates for new mortgages.

When that introductory period is over, the interest rate can change periodically. Oftentimes, interest rates on these variable interest rate mortgages will increase over time (possibly every month or every six months). They can also decrease over time, depending on market conditions. These increases/decreases are based on the average of how much interest other banks are charging (in the UAE, this is known as the Emirates Interbank Offered Rate (EIBOR or EBOR)).

This interest rate on a variable mortgage will only change on a set schedule and will be limited in how much it can change. For instance, the bank might change a variable mortgage rate every six months.

If other banks in the UAE are charging more for mortgages, the interest rate on a variable mortgage is likely to increase; if other banks are charging lower rates, the variable interest rate might go down, too. Though a variable interest rate can change in either direction, there is no way to know when rates will go up or down, or how much they might change.

You may find a fixed interest rate more beneficial because it offers predictable payments that make budgeting easier, and it allows you to lock in a low interest rate. But if interest rates are high, a fixed interest rate can make it difficult to qualify for a loan. In this case, you may want to refinance to take advantage of potentially lower interest rates in the future.

Variable interest rates can provide a lower interest rate early on in the loan but are subject to unpredictable changes. Variable rates make budgeting more difficult since future payments will be different from payments today. This unpredictability does come with the silver lining that if interest rates fall, you could be rewarded with a lower rate on your variable loan without having to refinance.

The views shared in this podcast are for general information and educational purposes only and do not constitute financial, investment, legal or tax advice. Listeners should seek independent advice from a qualified professional before making any financial decisions. Emirates NBD Bank PJSC accepts no liability for any loss arising from reliance on the content discussed.