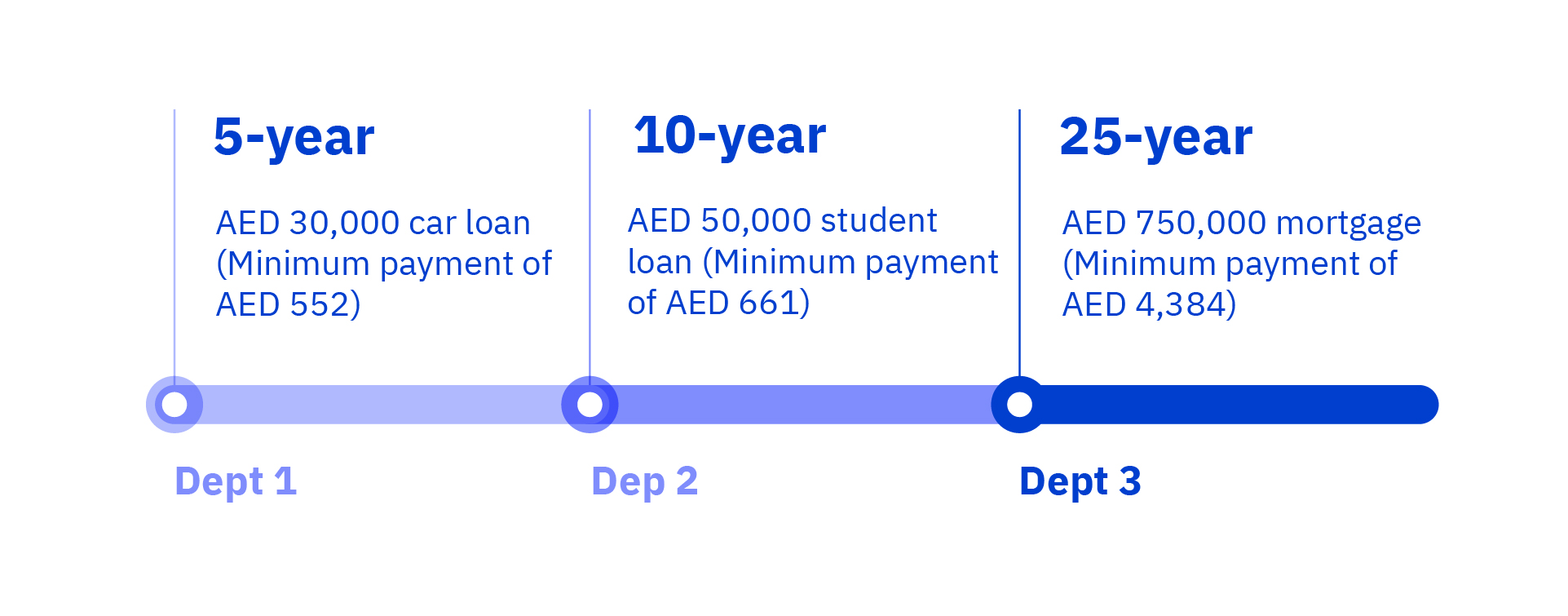

The snowball method works by focusing all your attention on your smallest debt. Unlike other debt payment strategies, the snowball method is only concerned with the size of your loan balance, not the interest rate. For example, let’s say you have 3 loans: a mortgage with AED 750,000 remaining at 5% interest, a school fees loan of AED 50,000 at a 10% interest rate, and an AED 30,000 car loan at a 4% interest rate. The snowball method says you should pay off the smallest debt (the car loan) first, even though it has the lowest (i.e., best) interest rate.

The next step in the snowball method would be to take that same amount you just paid for your smallest loan (the car loan) and apply it to the next smallest loan (the school fees loan). Let’s break this down:

Step 1: Pay off the smallest debt – your car loan – as quickly as possible.

Step 2: Once the car loan is paid off, move on to the next smallest debt, your school loan.

Step 3: Take the minimum payment of AED 552 that you previously used to put toward the car loan and add it into the minimum payment for the student loan of AED 661, for a monthly payment of AED 1,213.

Step 4: Then, once you’ve paid off the school fees loan, repeat this process of adding the minimum payments from that loan (AED 1,213) to the mortgage loan to help pay off that debt sooner.

The views shared in this podcast are for general information and educational purposes only and do not constitute financial, investment, legal or tax advice. Listeners should seek independent advice from a qualified professional before making any financial decisions. Emirates NBD Bank PJSC accepts no liability for any loss arising from reliance on the content discussed.