To get started, we’ll take you through some important things to consider before taking that loan:

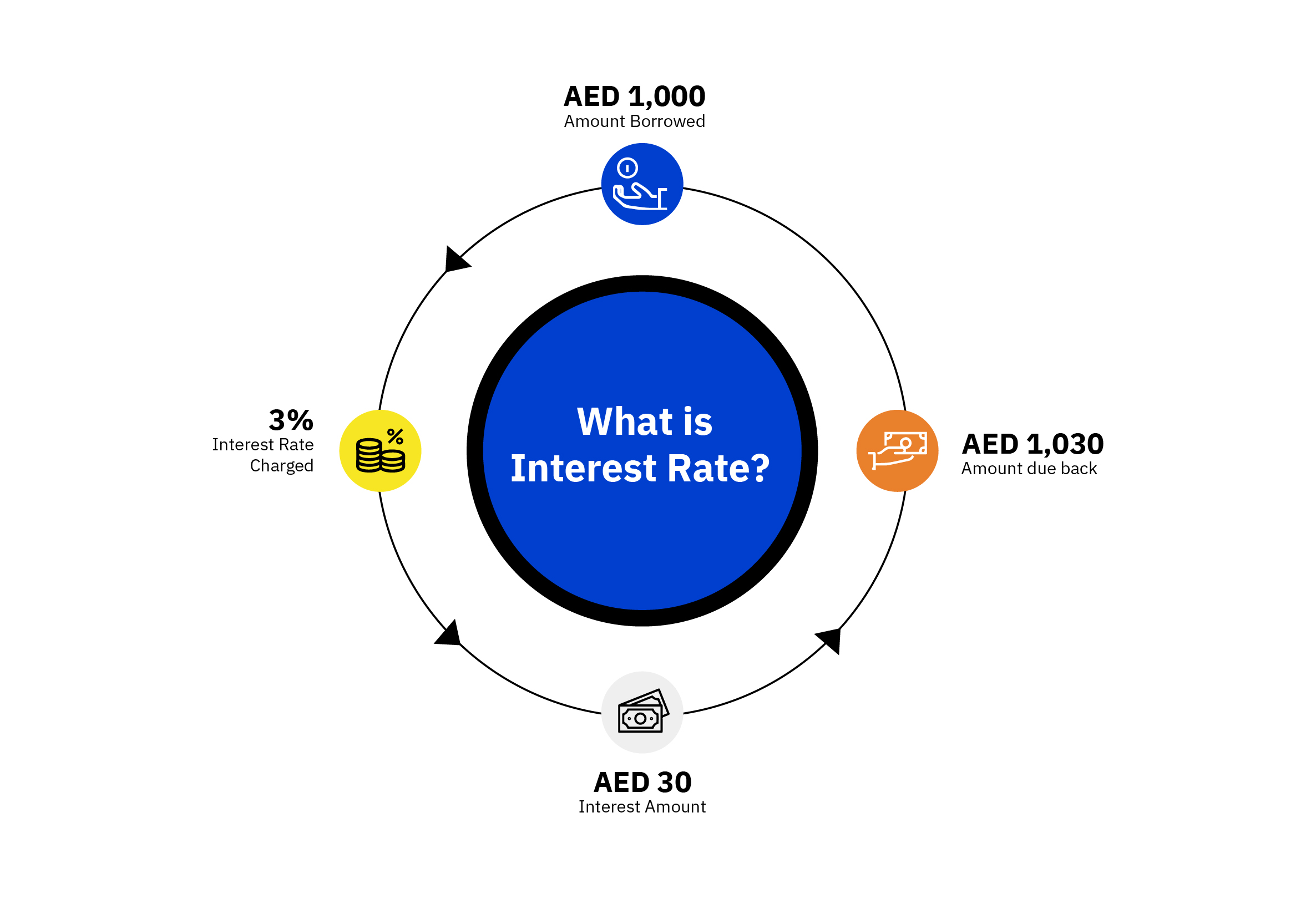

Because they’re taking a risk by loaning money, lenders charge a fee, known as interest, that the borrower must pay back along with the original borrowed amount.

Let’s say you want to borrow AED 1,000 and a lender offers an annual interest rate of 3%. At the end of the year, you will owe AED 1,030 (AED 1,000 + AED 30 for interest) to pay back the loan.

It’s important to pay attention to the interest rate, since lenders charge different interest rates based on the type of loan and how qualified you are to borrow money.

Debt is money owed to someone else (like a bank). Whether you use a credit card or take out a loan, you need to be aware that debt will rapidly increase if you don’t pay what is owed on time, because interest can accumulate and grow quickly. The good news is that you can easily avoid getting buried under a mountain of debt by:

When it comes to loans, credit cards, or any other debts, make sure you keep an eye out for these:

Now that you know the basics of borrowing, you can decide whether a credit card or loan is best, or if you should borrow money at all.

Whichever one you choose, remember that living within your means and prioritizing savings is the first step to financial security and building wealth.

The views shared in this podcast are for general information and educational purposes only and do not constitute financial, investment, legal or tax advice. Listeners should seek independent advice from a qualified professional before making any financial decisions. Emirates NBD Bank PJSC accepts no liability for any loss arising from reliance on the content discussed.