The term ‘Index’ refers to the strategy or approach of the fund, because it is tied in with a larger index that measures the performance of a group of securities, such as S&P 500, Dow Jones Industrial Average, Russell 2,000, Nasdaq Composite, Schwab 1,000, and others. Some mutual funds and Exchange Traded Funds fall within the purview of Index Funds.

Index Funds can be broad market-based by tracking the performance of all the securities in a market index or choose a sample of securities within the index based on a certain sector or a specific investment strategy.

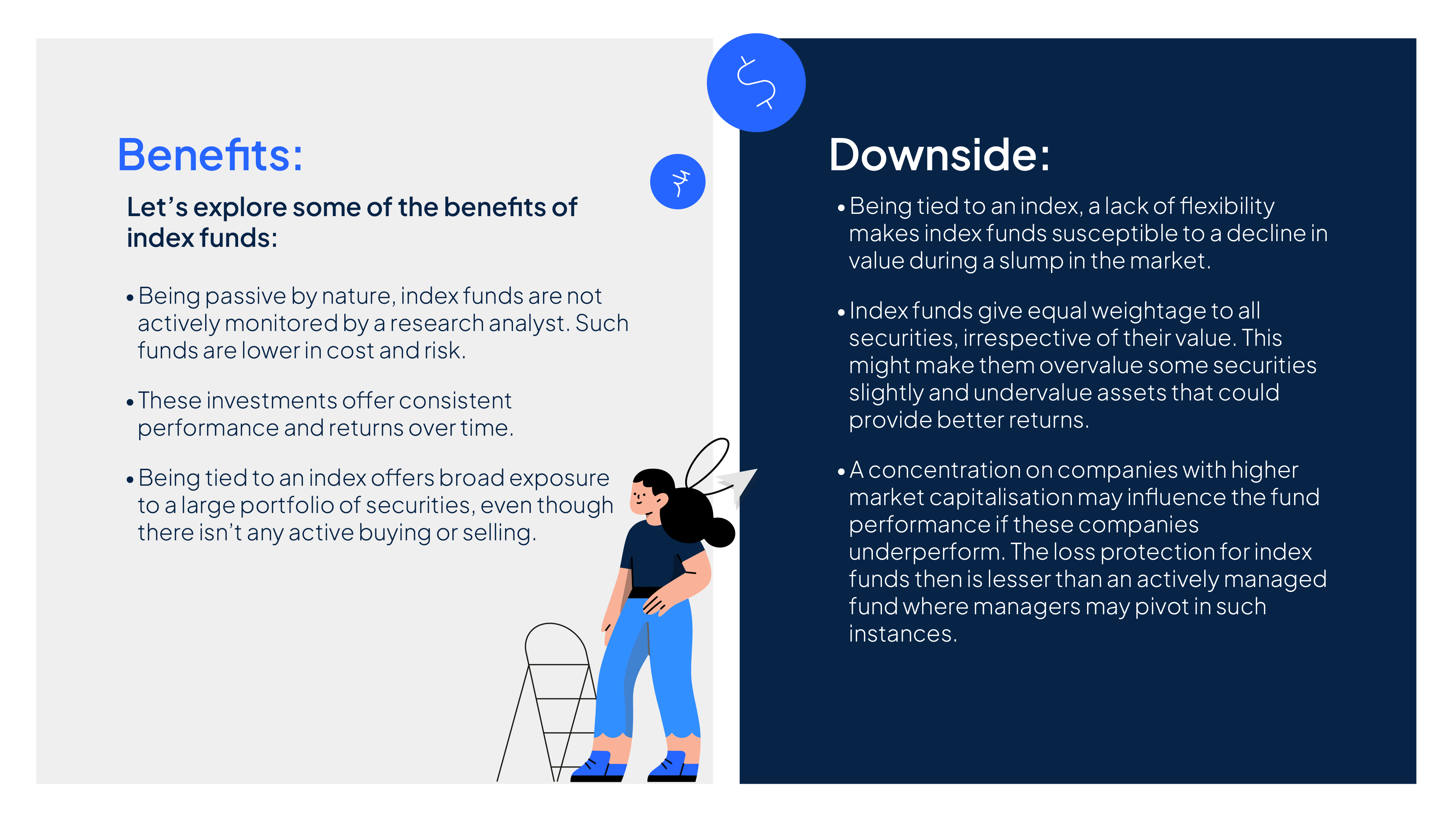

This broad diversification makes it a passive style of investment and these funds are more long-term by nature because they maximise returns over the long run. There is low activity, which means fund managers do not spend time buying and selling securities very often and there is no resource actively analysing the index. These inherent qualities make them a good option for many, especially millennials, who do not have the time to actively track funds and invest. Passive investment through index funds is now gaining increasing acceptance among investors who prefer to let their wealth build over time.

Before you decide to opt to invest in an index fund there are some key things to consider:

Do you wonder why an index fund does so well over time? This is because these funds that you invest may be reinvested in the long run and make for valuable gains in the future. This is because the interest is compounded every time dividends are reinvested. You can read here for more information on compound interest and how it works.

To conclude, an index fund may be a lucrative investment, but it always helps to do your homework before you decide to invest.

The views shared in this podcast are for general information and educational purposes only and do not constitute financial, investment, legal or tax advice. Listeners should seek independent advice from a qualified professional before making any financial decisions. Emirates NBD Bank PJSC accepts no liability for any loss arising from reliance on the content discussed.