A stock represents ownership in a company. When someone buys a stock, they’re given shares that represent partial ownership of the underlying company

The stock market is where investors buy and sell stocks of different companies. In a way, the stock market is like a physical market where people can buy and sell goods – or at least it used to be. Today, the stock market exists almost completely online, with most people buying and selling stocks electronically. Before the internet was born, stocks were traded either by phone or in-person and required a paper certificate to prove ownership of a company’s stock.

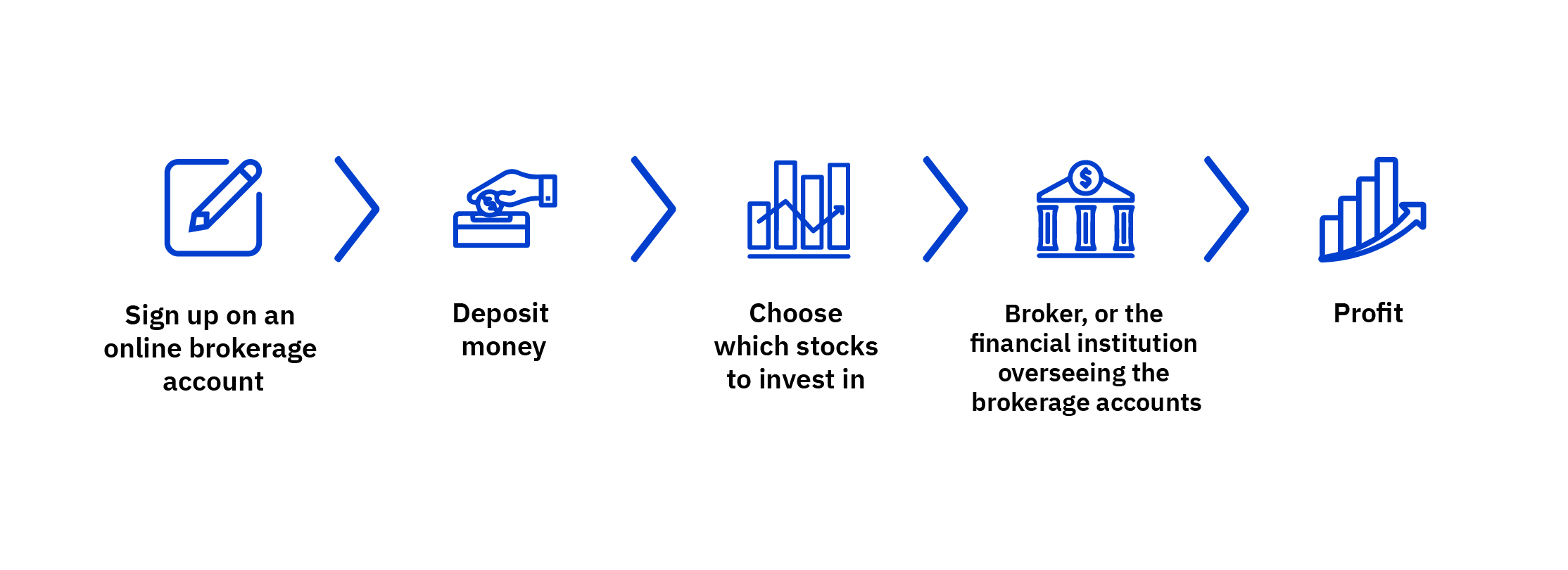

The best way to invest in the stock market is through an online brokerage account. Using a brokerage account, you can deposit money and choose which stocks to invest in. The broker, or the financial institution overseeing the brokerage accounts, will carry out the purchase or sale of stocks on your behalf. For an additional fee, some brokerages can also advise on what investments to make if you’re not too sure.

When people refer to the price of the stock market, they’re usually talking about stock indexes such as the S&P 500, the Dow Jones Industrial Average or the Nasdaq Composite, to name a few of the biggest ones. A stock market index tracks the performance of a group of stocks in a standardized way. This basket of stocks typically replicates a certain area of the market such as healthcare or technology, or market capitalization. The S&P 500 for instance tracks the performance of the 500 largest companies listed on US stock exchanges. There are also country specific indexes such as the Nikkei in Japan, the Hang Seng in China and the National Stock Exchange (NSE) in India.

Buying shares in the S&P 500 is an investment in a basket of stocks, allowing investors to follow the performance of all 500 companies’ stocks collectively. Since the price of any one company’s stock can go up but it can also go down (depending upon a number of factors at any given point in time, such as the state of the economy in general, company leadership, company talent and the company’s product line, amongst others). Investing in a basket of stocks is a form of diversification to balance out when one stock in the basket is going up and another stock in the basket is going down. Of course, during a recession, most stocks would be trending downwards. In times such as these, some investors who can afford to, choose to stay invested until the market recovers.

There are two main ways to make money in the stock market – selling for a profit and receiving dividends.

Buying low and selling high is a popular investment strategy where investors try to find stocks (or stock indices) to buy at a low price, then make a profit by selling at a higher price. Say an investor buys Nike stock at AED 800 per share. A year from now, Nike stock is worth AED 1,000 per share, so the investor chooses to sell their Nike stock shares and make a profit of AED 200 per share.

When a company is doing well, it may pay investors a dividend, which is a distribution of part of a company’s profits with its stockholders. Companies use dividends to reward shareholders and attract new investors. Dividends are usually paid out quarterly, though some companies may pay just once a year. Dividends are never a guarantee, but for investors who have chosen stock in an established, successful company, dividends can be a great way to earn money without having to sell their shares. Of course, companies are not able to pay out dividends when they are not doing well.

For hundreds of years, the stock market has been helping people build wealth. Anyone can invest in the stock market, even if they’re making small investments. While you certainly can earn money in the stock market, it’s important to remember that it comes with risks including the possibility of losing all your money, if a company goes bankrupt, for example. Always consult with tax, legal and financial advisors before making complicated investment decisions.

The views shared in this podcast are for general information and educational purposes only and do not constitute financial, investment, legal or tax advice. Listeners should seek independent advice from a qualified professional before making any financial decisions. Emirates NBD Bank PJSC accepts no liability for any loss arising from reliance on the content discussed.