Investing is a long-term process, and this can mean waiting years, or even decades for your investment to grow. Of course, growth is not always a guarantee, you have to be prepared for losses as well depending on where you invest, and the risk involved.

Here are four recommendations to keep in mind before you invest:

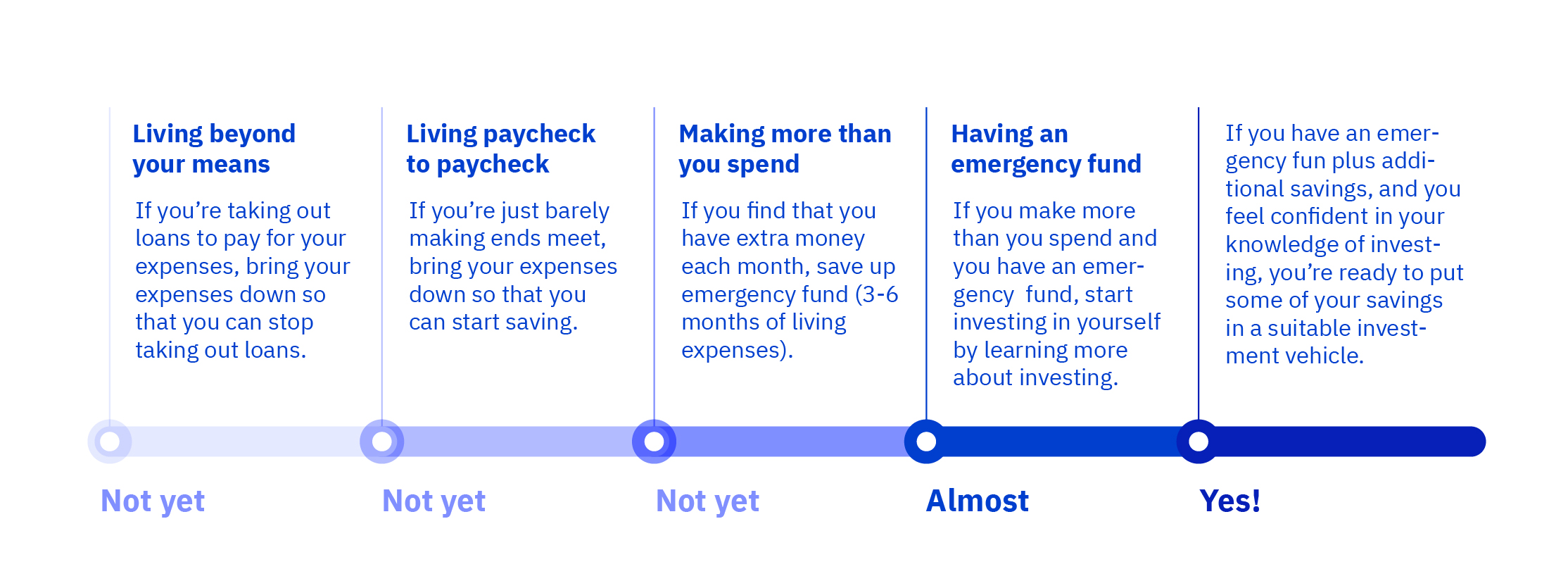

Before you even start thinking about investing, you must make sure your personal finances are secure. Here’s how:

Save regularly

Putting money aside every month is the first step to succeeding with your long-term financial goals. Keep a close eye on expenses and stick to a budget to ensure you build enough savings for a secure future.

Think ahead

It’s important to be prepared for anything life may bring your way – both planned as well as unexpected events. You may want to take a career break to go back to university, plan a sabbatical to travel the world, or even start a family. Whatever your reasons, make sure you secure yourself with enough savings to cover these expenses. While it’s recommended that a savings fund should cover between 3-to-6-months of your living expenses, it’s a good idea to also start goal-based savings plans and contingency savings plans that will help with life’s unexpected events.

Consider borrowing

Borrowing can help you buy today what you would otherwise have to save years for. But it’s important that you borrow for the right reasons and under the right terms, ensuring that you can pay back. For example, taking an educational loan is an investment towards a better future and taking a mortgage for a home allows you to build equity in the form of real estate. On the other hand, borrowing for a holiday or to buy an expensive phone is not a smart choice. It’s more advisable that you save up for these goals.

There are many ways you can borrow – taking loans (loans, home, auto) or even through credit cards. Whatever you choose, consider the pros and cons of each kind of loan before you commit. Read all the terms and conditions. You can always call the bank to discuss your needs and have experts advise.

Check out these basic guidelines that will help you know if you’re ready to start investing.

Once you master budgeting, saving and borrowing for the right reasons, investing is the next step which will help you build a strong financial portfolio. It’s important to know and understand where and how to invest, the different types of investments available, and how to evaluate risk before you put any money into an investment.

Types of investments

Here are some types of investments to consider. For more information, reach out to a financial advisor who can advise you better, based on your specific requirements such as age, income and appetite for risk.

Stocks

Stocks represent small percentages of ownership of a company. When you buy stock in a company, you become a shareholder. The value of the stock may go up if the company makes a profit or reports positive news. If this happens, you can sell the stock and make a profit. For instance, if you buy shares in a company at AED 40 per share and the value increases to AED 60 per share, you can sell to make a profit of AED 20 per share. But stock prices can fall too, and if you choose to sell at a lower price you bought at, you will lose money. The trick is to hold onto your stock until you can make a profit if possible. Be mindful though that stocks rising in value is not always a given – so invest in strong companies that have the potential to grow.

Some companies share their profits with shareholders in the form of dividends, which is a distribution of profits to the shareholders. Dividends are often distributed quarterly and may be paid out in cash or in the form of additional stock.

Tip: The value of a stock changes every day. Keep track of how the company is doing by reading the latest news and monitoring how analysts are valuing a company and its prospects.

Mutual funds

A mutual fund uses money from multiple investors to buy a number of stocks, bonds, and/or short-term debt. This pool of money is managed by a fund manager who takes a small fee for their service. Just like you would invest in stocks, you can buy shares in mutual funds as well.

The benefit of buying shares in a mutual fund is that it creates instant diversification for your portfolio without you needing to invest a lot of money. When a fund earns money, the earnings are divided between the investors according to their holdings and the share price rises. The opposite applies too, if there are lossesthe shares will decrease in value.

Bonds

A bond is a form of debt that companies or governments use to help fund their operations and cover expenses. When we buy a bond, we are lending money for a certain period of time with an expected payment of interest in return. The interest on our bond is the return we receive for lending out our money. When the bond reaches maturity (the date on which the borrower must pay back the loan), we are paid the initial amount that we invested (known as the principal) along with interest.

Real estate

While many people buy property to live in themselves, real estate can also be a great investment. Real estate values can increase or decrease over time as a result of changes in the market and economy. You can profit from a real estate investment either by renting out your property or by selling it for more than what you purchased it for. Investing in real estate does require more attention than other investments, as properties have regular expenses tied to them, like mortgage payments or maintenance costs.

Cryptocurrencies

Over the last few years, there’s been a buzz around cryptocurrencies, also known as digital currencies. Cryptocurrencies allow anyone, anywhere to send and receive payments without using a centralised, trusted third-party such as a bank. These digital assets are secured with cryptography on blockchain networks making them almost impossible to counterfeit or censor. Though many investors have made a huge amount of profit by trading in, or buying and holding cryptocurrencies, the recent crash of the cryptocurrency market shows how risky this can be. Cryptocurrencies are still not well understood, prices have been volatile, and they are not as heavily regulated (if at all) as other mature financial products. For these reasons, it’s best to proceed with extreme caution before investing in this brand-new asset class.

No matter how great an investment may seem, it’s advisable to never put all your money into one asset. If you have multiple investments in your portfolio, then your exposure to any one type of asset is limited. If one asset decreases in value at a certain point in time, it’s likely that the other assets in your portfolio may remain strong and make up for the losses.

This strategy of putting money in a variety of different investments is known as diversification. With diversification, you can limit your risk by making sure your portfolio has some assets that perform well, even if others don’t. Think of it as trying to balance it out.

Investing can help pave the way towards financial growth and security. Remember, knowledge is key - arm yourself with all the info you need and research the latest financial trends and analysis. A financial advisor can provide impartial advice tailored to your unique situation, taking into account your age, lifestyle, income, and other factors.

The views shared in this podcast are for general information and educational purposes only and do not constitute financial, investment, legal or tax advice. Listeners should seek independent advice from a qualified professional before making any financial decisions. Emirates NBD Bank PJSC accepts no liability for any loss arising from reliance on the content discussed.