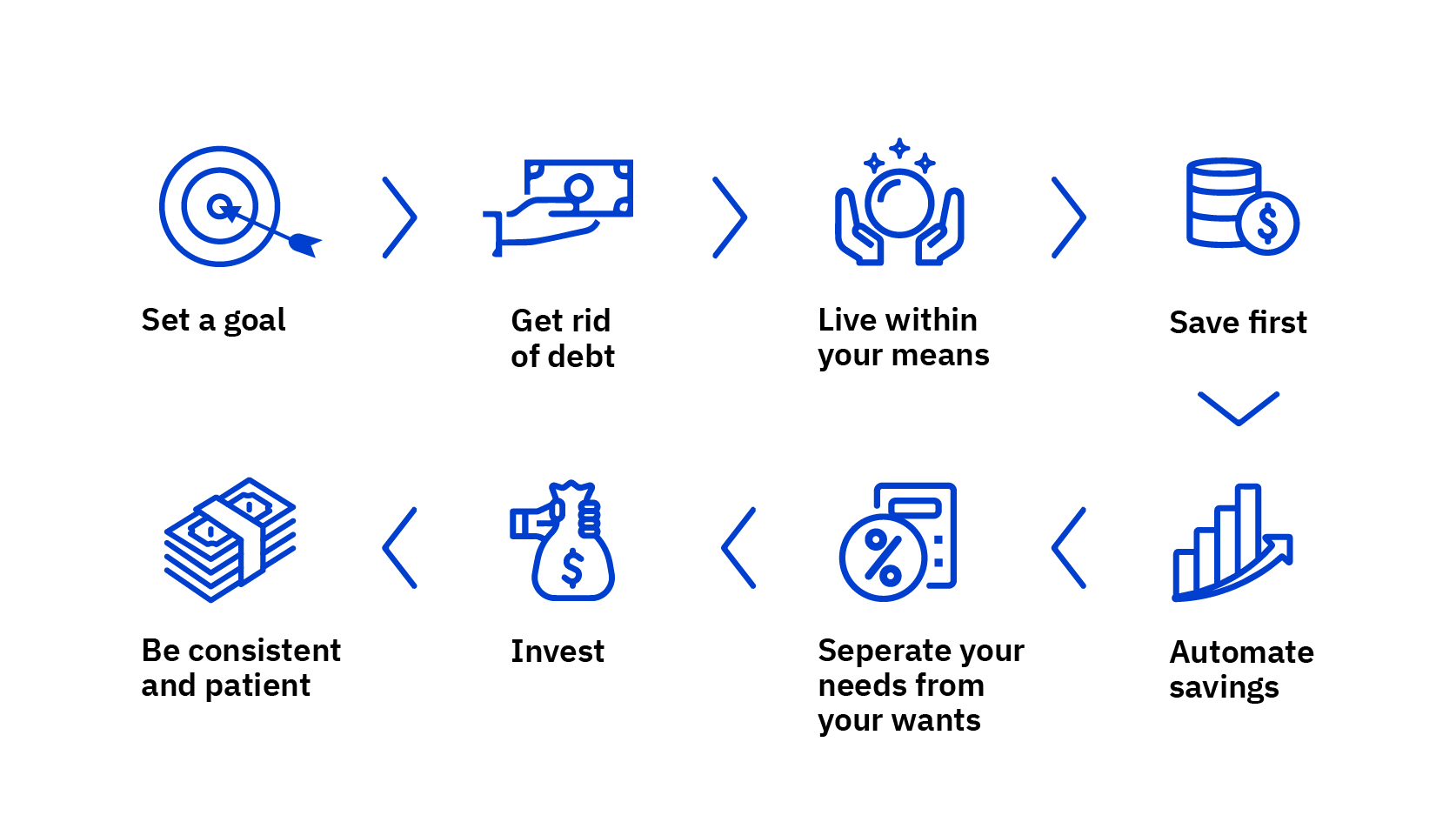

A great way to start saving right away is to set a savings goal and write it down. Even if that goal has to be adjusted later, having a target you’re working towards can help motivate you and keep you on track.

Debt can make saving money much harder. So work towards paying off loans with higher interest rates sooner rather than later, or move the higher interest debt into lower interest loans (also known as “debt consolidation”). Eliminating unnecessary or expensive debt is a key step in freeing up money to put toward savings.

Just because you can afford to buy something, doesn’t mean you should. Beware of “lifestyle creep” (spending more money as earnings increase). Instead, try to keep your lifestyle and expenses the same as your earnings grow. This way, you can use the extra money to save even more.

Another great habit is to save first. The idea behind saving first is to set aside money in your budget for your future self before spending money on yourself today. One great way to save first is to have a set amount of money or percentage of your income automatically moved into a savings account.

Automating savings is the simplest way to ensure your savings goals are met. You’ve worked hard to earn your money, so saving it shouldn’t require any extra effort. Use technology to make saving seamless, such as setting up recurring, automated savings on a weekly, bi-weekly, or monthly basis.

Separating the things you need from the things you want can help you reduce spending and save more. If you’re not sure where you’re going to find the money to start saving, create a list of needs and wants, then see if any of your “needs” actually belong in the “wants” category; and what expenses from your “wants” you’re able to live without.

It’s essential to have some short-term savings in cash for emergencies and other surprises, but a savings account with the bank probably won’t grow much, even over time. If you can afford to wait a few years, investing some money in the stock market or on other investments may help you earn passive income and get the most out of money that you’ve already saved.

Building good savings habits requires consistency and patience. Like most things, saving money takes time. Focusing on saving regularly over the long term is a better strategy than contributing to your savings once in a while. If you’re not able to save a lot right away, that’s okay. What’s most important is that you start saving today, no matter how small, and continue to save consistently over many years.

The views shared in this podcast are for general information and educational purposes only and do not constitute financial, investment, legal or tax advice. Listeners should seek independent advice from a qualified professional before making any financial decisions. Emirates NBD Bank PJSC accepts no liability for any loss arising from reliance on the content discussed.