The first step in saving is to actually start with your end goal. Having a realistic goal will generate motivation to work towards it. The more you see that number and the closer you get to it, the more you will want to reach it.

Start by making sure your expenses are less than your income. The lower your expenses, the more you can save, and the sooner you can achieve your goals.

When you receive your salary, set aside a fixed amount of money to go directly to your savings. Consider a recurring deposit and setting up standing instructions with your bank for your savings to be moved automatically to your deposit account when your salary comes in. A recurring deposit often will give you a better interest rate and the power of compounding interest will kick in too. This is an effortless way to grow your savings, consistently.

A good step towards more effective savings is to create a budget tracker. This will help you track how much money you make and spend each month. First, list ALL the money you have coming in – this can include income from a job, investments, trust fund, or anything else. Then, list the money you spend every month by category, like groceries, rent, and utilities. Now, deduct the money spends from the money coming in, this will give you the amount you can potentially save each month.

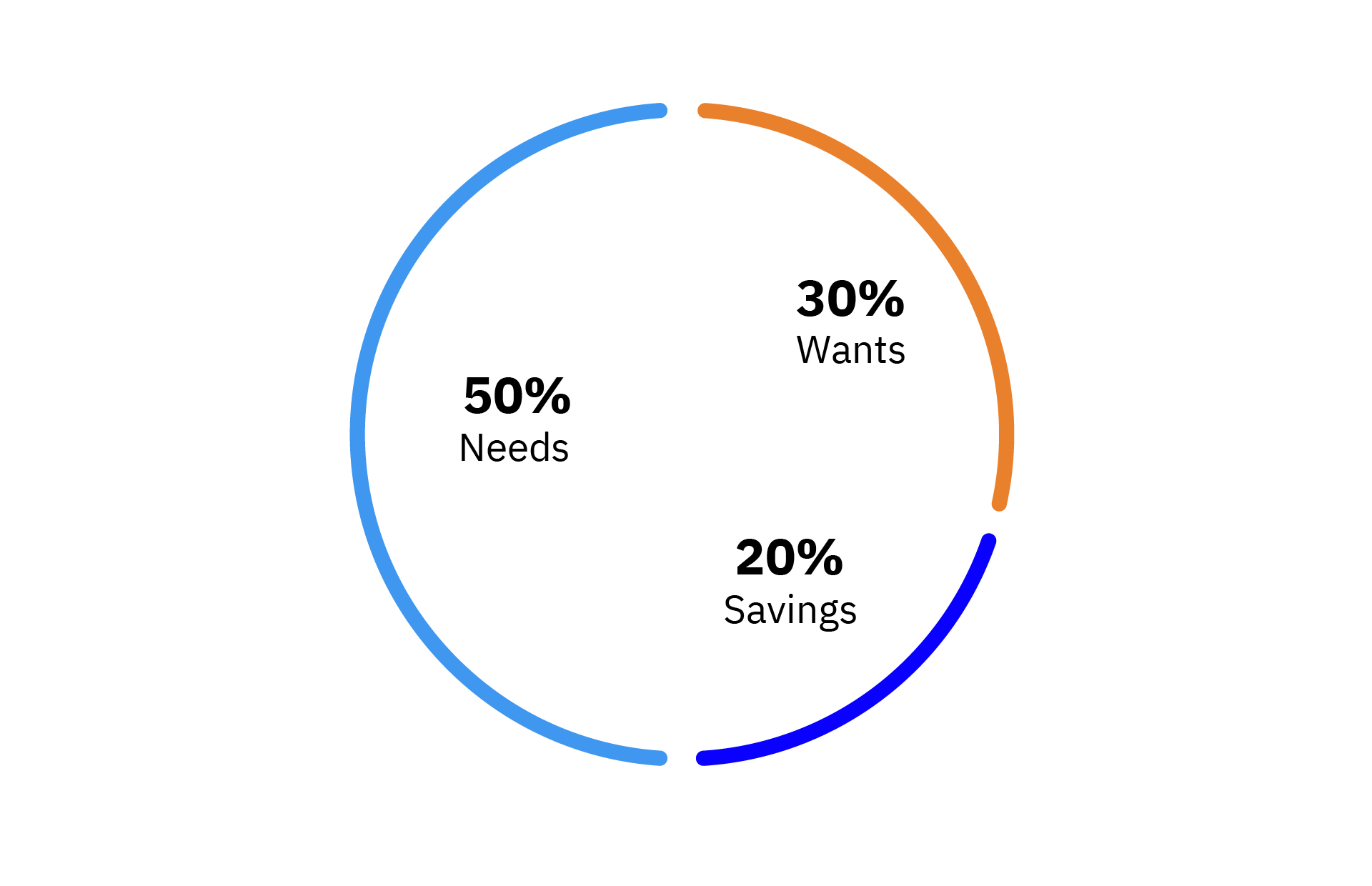

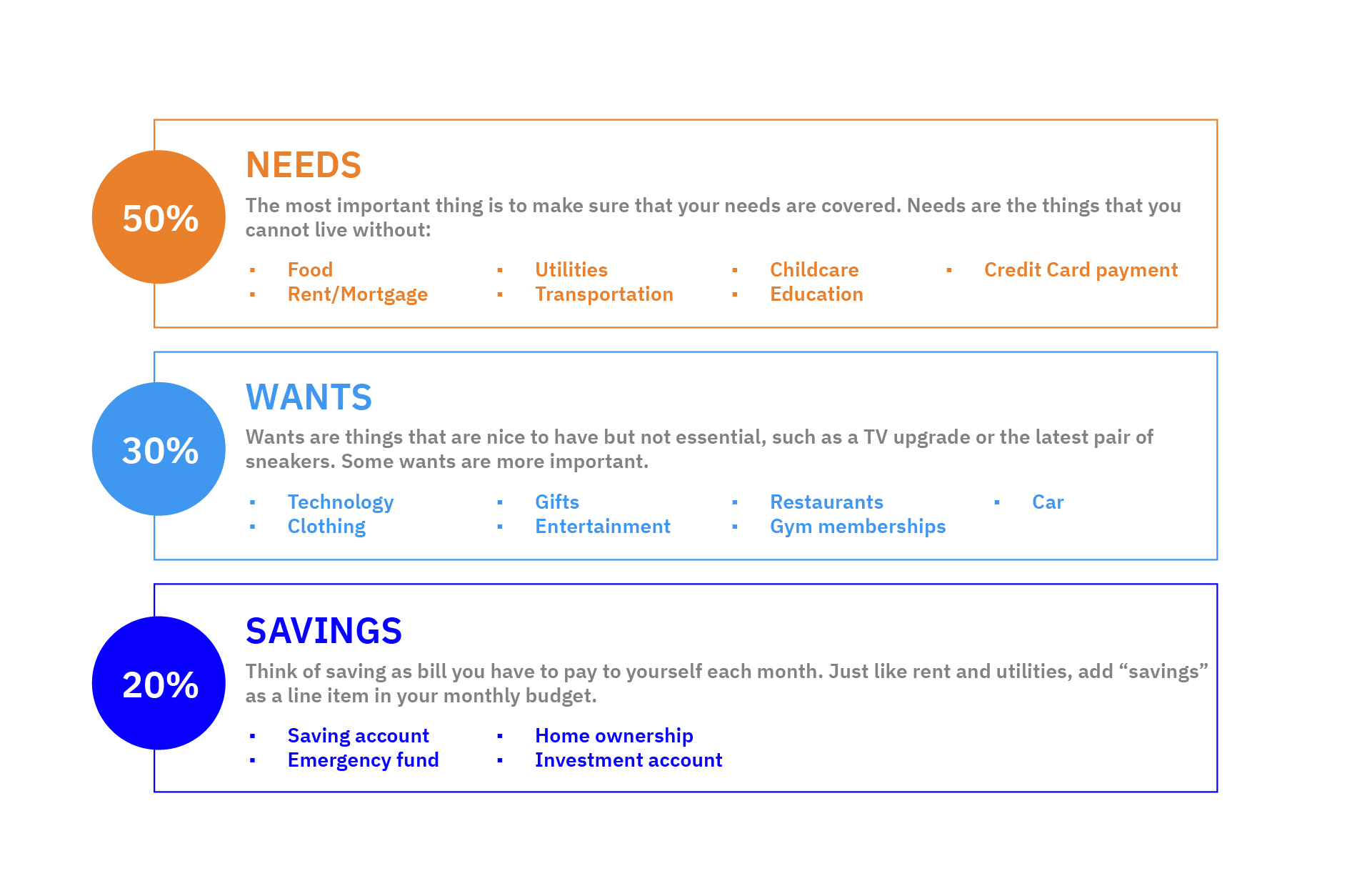

When it comes to saving money, the 50-30-20 rule really helps. This rule states that spending should be divided into three categories:

Needs

Needs are what you spend most of your money on. This is everything that’s essential like rent, utility bills, grocery shopping and so on. If your spending on needs exceeds 50% of your total income, then it’s time to start looking at where you can cut back on spending. Check if you can find a cheaper flat and lower your rent, or use a credit card that gives you discounts on groceries and other essential purchases.

Wants

Wants should make up 30% of your total spending. This includes shopping, entertainment, travel and other such expenses. Although you may “want” to spend more on this category, keeping your spending below 30% will ensure you have enough money left over for savings.

Savings

If you’ve kept your spending in the other two categories within their limits, you should have 20% of your income left to save and invest. This is essential to building a long-term financial plan, as well as handling any unexpected changes in life. A good rule of thumb is to save at least 6 to 12 months' worth of living expenses, in case of emergencies or unplanned events.

Think of Savings as a bill you have to pay to yourself every month

Here’s an easy guide to explain the 50/30/30 rule better and illustrate how to divide your income accordingly:

While this rule is a good guideline for how to spend and save, it can always be adjusted depending on your income. Low-income earners might need to use a bigger portion of income on needs, and less on wants and savings. But for high-income earners, spending 50% of income on needs might be too high. In this case, you can increase savings and put that extra amount towards investments. The important takeaway here is that no matter how much money you make, always live within your means.

Once you’ve built up some savings, you can earn interest on it by investing it in a fixed deposit at a bank. Simply put, interest is the money a bank pays you on your deposits and savings with them. With simple interest, you are paid at the end of every year.

Take a deposit of AED 1,000, for example. The total interest you earn after 3 years is AED 30.

Simple Interest

| Amount (AED) | Interest | Interest (AED) | Total (AED) | |

|---|---|---|---|---|

| Year 1 | 1,000 | 1% | 10 | 1,010 |

| Year 2 | 1,000 | 1% | 10 | 1,010 |

| Year 3 | 1,000 | 1% | 10 | 1,010 |

You can also benefit from compound interest. Compound interest is when you earn interest not just on your deposited money, but on top of the interest you already earned.

For example, if you deposit AED 1,000 into an account that pays 1% annual interest, you would earn AED 10 interest after 1 year. Thanks to compound interest, in year 2 you would earn 1% on AED 1,010 (the original amount plus the interest), and so on. Compound interest multiplies your money over time, more than simple interest.

Compound Interest

| Amount (AED) | Interest | Interest (AED | Total (AED) | |

|---|---|---|---|---|

| Year 1 | 10,000 | 1% | 10 | 10,100 |

| Year 2 | 10,100 | 1% | 10 | 10,201 |

| Year 3 | 10,201 | 1% | 10 | 10,303 |

Total interest earned after 3 years = AED 303

This might not seem like a big advantage, but the bigger the amount you save and the longer you keep the fixed deposit in the bank, the more it compounds and the more your savings will grow.

The same way that regular exercise helps you achieve fitness goals, adopting the right saving habits early will help you build a more financially secure future. If you haven’t set up a savings plan yet, make a start now, it’s never too late!

The views shared in this podcast are for general information and educational purposes only and do not constitute financial, investment, legal or tax advice. Listeners should seek independent advice from a qualified professional before making any financial decisions. Emirates NBD Bank PJSC accepts no liability for any loss arising from reliance on the content discussed.