A fixed deposit is a banking product that allows you to be paid interest on your deposit for a fixed amount of time. This is also referred to as a term or time deposit. You put money into a fixed deposit for a set amount of time, anywhere from 7 days to 5 years or more. The original amount you put into a fixed deposit — also known as the “principal amount” — is guaranteed. And you earn interest on it.

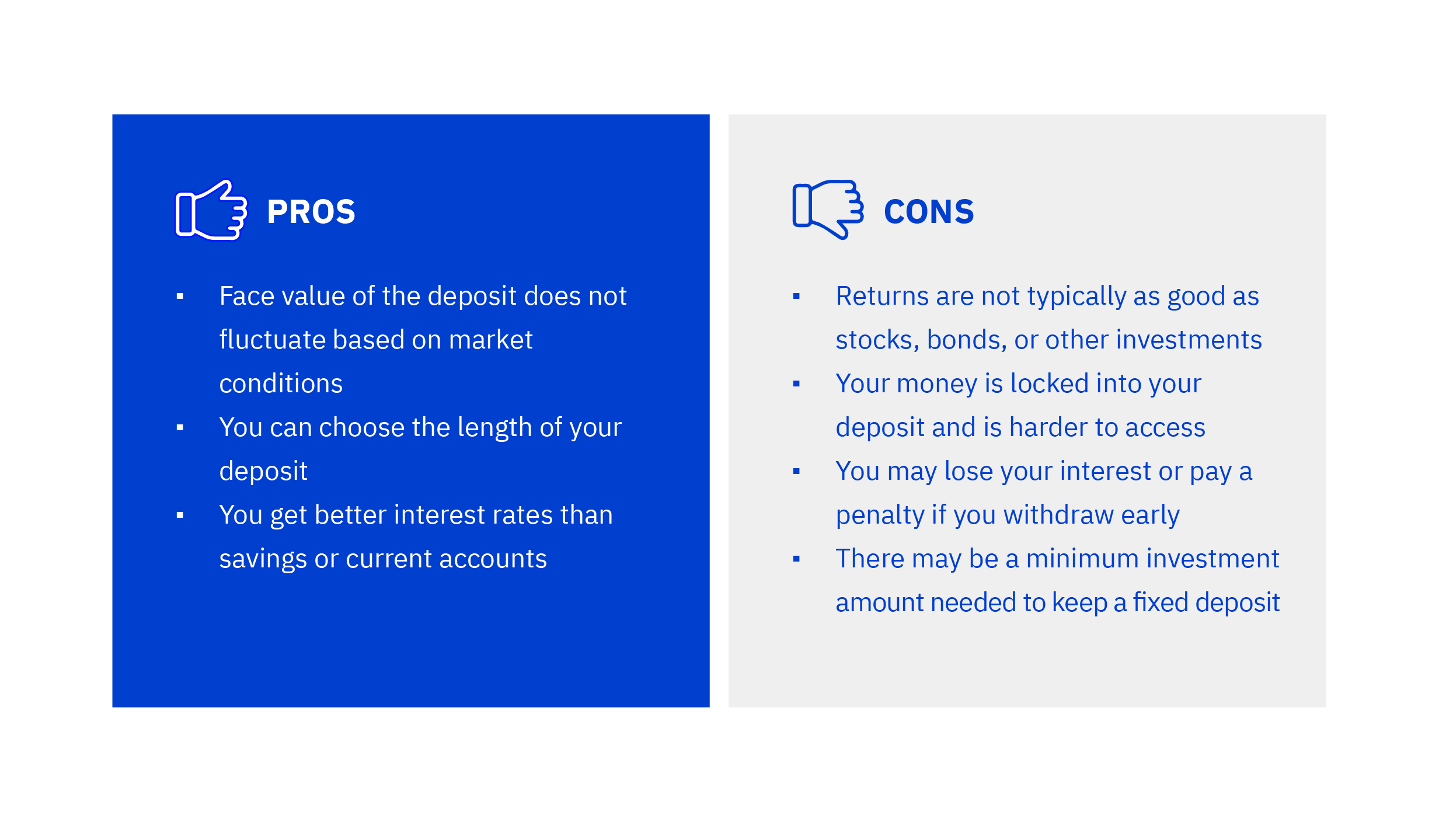

A fixed deposit is a much safer way of getting a return on your money, compared to other investment products like stocks or bonds. You’re guaranteed a fixed interest (or “return”) as long as you keep the money in the bank for the contractual period.

Unlike other investments, a fixed deposit ties your money up for a specified length of time. In general, the longer you deposit your money, the better the interest rate that will be offered to you. But that also means you may not withdraw your money before the end date of the term deposit. If you need cash suddenly, you might suffer a penalty and lose interest for withdrawing your money prematurely.

Your principal amount in a fixed deposit is guaranteed by your bank and you’ll receive interest for your deposit. If you really want to get the most out of your fixed deposits, you could also consider reinvesting the interest that you earned back into a fixed deposit, to get compound interest on your money. Compounding your interest over time will create even more savings than before.

Sure, you won’t be making a large amount of money with a fixed deposit like you potentially could in the stock market, but you also won’t be taking the risk of losing your money either. This makes fixed deposits a good, safe choice for your portfolio.

Financial Wellbeing: The information provided herein is for educational and informational purposes only and is not intended for trading purposes or to be passed on or disclosed to any other person and/or to any jurisdiction that would render the distribution illegal. You may not offer any part of the information provided herein for sale or distribute it over any medium including but not limited to a computer network without the prior written consent of ENBD.

The information provided herein does not constitute investment advice and is not a distribution, an offer to sell, opinion, recommendation or the solicitation of an offer to buy any financial instrument or security. An investment if any, mentioned herein may not be suitable for all investors and if you are unclear about any of the information provided herein, please consult your accountant, banker, broker, lawyer, tax adviser or other professional adviser. You must make your own independent decisions regarding any security or financial instrument.

The appropriateness of an investment activity or strategy will depend on the person’s individual financial circumstances, objectives and needs. Before entering into any transaction, the risks should be fully understood and a determination made as to whether a transaction is appropriate given the person’s investment objectives, financial and operational resources, experiences and other relevant circumstances.

Information has been obtained from sources believed to be reliable but no warranty is made as to the accuracy, completeness, reliability, suitability or usefulness of any information contained herein and no liability in respect of any errors or omissions (including any third party liability) is accepted by ENBD.

Past performance is not a guide to future results or returns and investors should be aware that the value of any investments and the income derived from them may fall as well as rise and they may not get back the full amount invested. Exchange rates may also cause the value of underlying overseas investments to go up or down.

Anything to the contrary herein set forth notwithstanding, ENBD, its affiliates, agents, assigns, directors, employees, officers, representatives, successors shall not, directly or indirectly, be liable, in any way for any: (a) inaccuracies or errors in or omissions from the information provided herein including, but not limited to, quotes or financial data; (b) loss, injury or damage arising from the use the information provided or downloaded herein, including, but not limited to any investment decision occasioned thereby; (c) consequential, direct, exemplary, incidental, indirect, punitive or special damages even if ENBD has been advised specifically of the possibility of such damages, arising from the use of information provided herein, including but not limited to, loss of revenue, opportunity, or anticipated profits or lost business

ENBD reserves the right to amend these Terms at any time without notice. These Terms shall be governed in all respects by the laws of the UAE. Emirates NBD Bank P.J.S.C. is regulated by the Central Bank of the UAE and by the Securities and Commodities Authority of the UAE.