Here are 6 ways to help manage your spending habits better

Expenses are part of your daily life. They may include rent, utility bills, groceries, school fees, health insurance, gym memberships, travel and so on. Of course, the amount of money that you choose to dedicate to each of these expenses depends on how much money you make, and how much you choose to invest or save.

Expenses can be divided into three major categories: fixed, variable, and periodic.

Fixed

These expenses remain the same every month and can include your rent, internet and phone bills, TV subscription, gym membership and so on.

Variable

These expenses change every month and can include groceries, fuel, utility bills, entertainment, shopping and so on.

Periodic

Car services and holidays are examples of periodic expenses. These expenses come about less frequently than fixed or variable expenses.

When you create a budget, break down your expenses into these 3 categories to help you become more aware of your spending patterns, so you know where you may be spending too much.

The money you earn can be divided into two categories: long-term income and short-term income.

Long-term income is money that comes in regularly every month, such as a monthly salary. Short-term income refers to income that is not earned monthly; it could be bimonthly, quarterly, or even a one-off payment. Examples of short-term income could be a bonus, income from your YouTube channel, earnings from stocks or freelance work, etc.

It’s very important to review your income and expenses based on how much money you have coming in. The best way to do this is by creating a budget.

It’s one thing to create a budget and another to stick to it. The key is to not spend more than you earn. To do this, you need to find ways to decrease your spending, or to increase your income. For example, can you get a flatmate? Can you cook at home more? Can you reduce your travel and recreation expenses? Can you stay away from unnecessary shopping? You made a budget. Your aim is to follow it.

The envelope method

The spreadsheet method

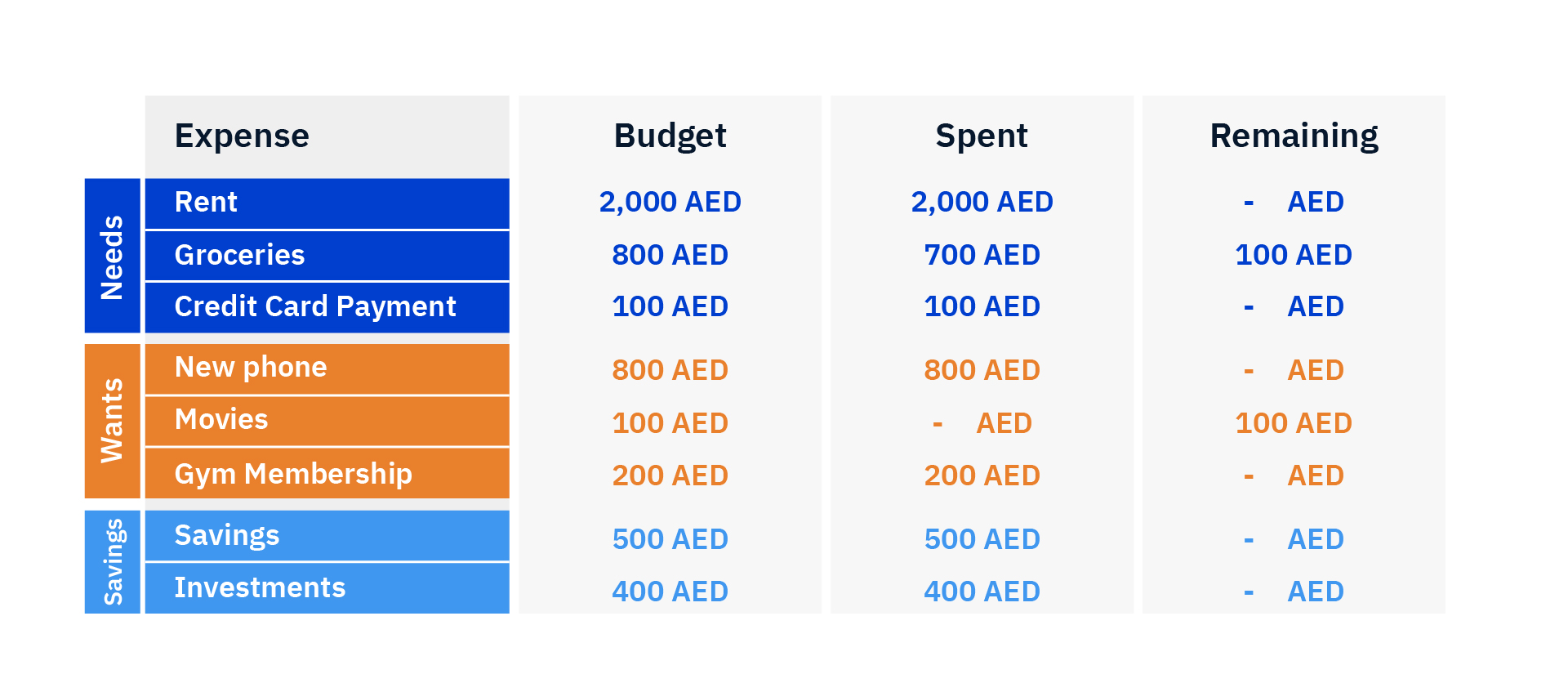

Here’s an example of a spreadsheet to track your budgeted versus actual expenses:

Tips to stop overspending

When your income stays the same, but you see your spending on essentials starts to increase for the same expenses, it’s likely due to inflation. When inflation is on the rise, the purchasing power of a single unit of currency decreases. As a result, you see a rise in prices of products and services that are essential to your day-to-day living such as food, clothing, housing and transport.

Because of inflation, one Dirham buys you less today than it did a few years ago. To beat inflation, you must look at ways of increasing your income at a greater rate than the inflation. You can look at making smart investments that give you good returns, working part-time jobs or even monetising your hobbies such as photography, art and design, etc.

You can’t go through life without spending money, but by understanding your spending habits and keeping to a tight budget, you can always find what works best for you without losing sight of your financial goals.

The views shared in this podcast are for general information and educational purposes only and do not constitute financial, investment, legal or tax advice. Listeners should seek independent advice from a qualified professional before making any financial decisions. Emirates NBD Bank PJSC accepts no liability for any loss arising from reliance on the content discussed.